In the Arena, Optionality in Investing, and Post-COVID Movie Theaters

In which I brainstorm how theaters could survive post-pandemic

Hey everyone,

Greetings from Washington, D.C.!

One of the best parts of writing this newsletter has been getting to meet other fellow writers – some of the most talented, ambitious, and kindest people I’ve ever met. Even out of this amazing group, Mario Gabriele stands out. He writers many different newsletters about tech and investing under the consortium of The Generalist, which he just re-launched as a completely different experience. Check out the announcement and subscribe to his work:

In this issue of Snapshots, I want to explore:

What did Richard Nixon do after resigning from the Presidency?

A Framework to think about optionality in investing

How movie theaters could survive in the post-pandemic world

Amazon’s logistics, Patek Philippe, and Castle Bravo

Book of the week

Let’s say that you’re the President of the United States. While you’ve had some successes during your time in office, you are disgraced by a single event towards its end. You leave the office facing a whole host of legal issues and are not sure where to go from there?

Of course, I’m talking about Richard Nixon in the aftermath of Watergate.

Writing In The Arena in 1990, 16 years after the end of his Presidency, Nixon covers a lot of ground. He outlines his life in the run-up to becoming the leader of the free world and reflects in the aftermath of his fall. It’s a deeply personal memoir – to the extent that an uncharacteristically ruthless politician like Nixon can be deeply personal.

Most refreshing is the ever-pragmatic Nixon’s description of the Watergate scandal that defined the next decade of American politics and continues to contribute to the “credibility gap” of the American presidency that started during Lyndon Johnson’s presidency. Nixon describes it as 1/3rd mistake, 1/3rd incompetency, and 1/3rd political. He accepts two-fold responsibility – first for not taking immediate action against his staff out of a misplaced sense of loyalty and second for having an atmosphere that made the responsible staff think that it would be okay for them to do this.

He reminisces on his political wilderness – “When you win, you receive phone calls from everyone. When you lose, you receive calls from your friends” – in a rich tradition followed most famously by Winston Churchill. During the 1930s, stripped of his ministerships and relegated to the back benches of English politics, Churchill developed an intelligence apparatus inside the menacing Nazi regime. Throughout this this time, he would write articles, go on radio shows, and give speeches about the growing threat of Hitler. When his “rendezvous with destiny” came, Churchill was ready.

Nixon had a more muted rendezvous. What is most interesting to me during this time period is how good Nixon’s personal relationships with foreign leaders were. He did worldwide tours after his presidency ended and talked shop with dignitaries across the globe. He was especially influential in explaining Western attitudes in the wake of Tiananmen to his “old Chinese friends.”

While it’s the kind of retrospective that is absolutely laced with a bent towards the positive – Nixon is the author and the subject after all – the book is well-written with spartan sentences. Overall, it left me with a more informed and better impression of the man than I went into the book with. A large part of that is because he gave time after the Presidency to write this book, unlike some other Presidents.

Long read of the week

A Framework for Understanding Optionality by Shaw Spring Partners

A great letter from Shaw Spring Partners detailing how they think about optionality in investing. They break down the different types of optionality and pepper in plenty of great examples.

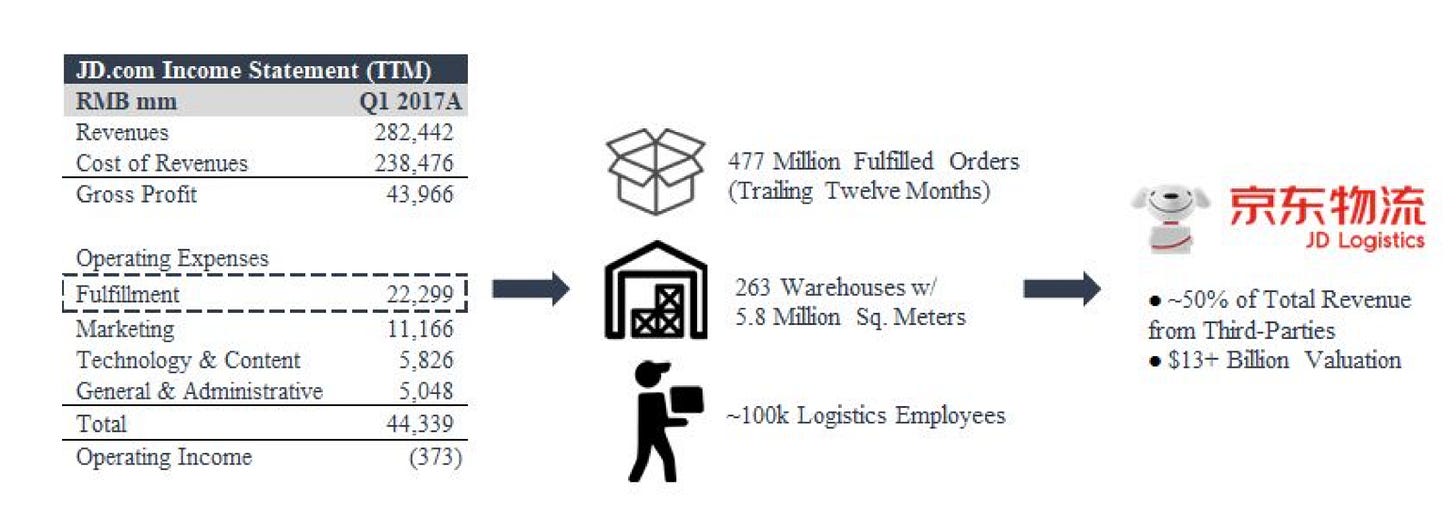

My favorite is the siphoning off of cost centers as infrastructure offerings:

JD.com [a Chinese e-commerce company] recorded RMB 22.3 billion (~$3.4 billion) in trailing-twelve-months fulfillment expenses a month prior to the spin-off of JD Logistics as a standalone business. While these fulfillment expenses accounted for more than half of JD.com’s total gross profit, in reality the fulfillment expenses indicated investments in logistics infrastructure that JD.com would leverage to create JD Logistics. As of Q3 2020, JD Logistics generates ~50% of its revenue from third party customers and is valued at $13+ billion. Once viewed as a cost center, JD Logistics is now a profit generator for the entire JD.com Group.

Optionality is ultimately important because of its implication for exponential growth:

When evaluating the future growth of companies, we notice the market frequently omits Optionality (or other variable factors) in its projections and oftentimes assumes some linearity of growth relative to current rates for the sake of projecting subsequent years’ financials. We believe that the human tendency to entirely omit the unknown when considering the future growth of a business, and to base future value on a linear pattern relative to present or past circumstances, oftentimes either over- or under- estimates the true valuation of a company.

If those excerpts intrigued you, I recommend you read the letter in its entirety.

Business move of the week

Can a Brash Executive in Kansas Save Movie Theaters? via the New York Times

This was a fascinating read about the CEO of AMC Entertainment, Adam Aron. The company owns and operates movie theaters across the globe. His strategy seem to be like the media mogul Logan Roy’s in HBO’s Succession – get so big that you can’t be taken down.

But it’s really the straddling of two paradigms. On one hand, he has to maintain the primacy of theaters when it comes to movie culture. On the other hand, empty seats because of the pandemic means that theaters companies are beholden to onerous terms from movie studios and streaming services.

I’ve seen some creative ideas being implemented in this space:

A subscription-model makes sense as long as it’s not ridiculous like Movie Pass (R.I.P.) as increased, higher margin revenue from concessions, etc. make up for any lost revenue on ticket sales.

Dynamic pricing for theatre tickets should be a complete no-brainer – just like it should be for any time-slotted business, but that’s for another post. If you want to watch something on a Friday or Saturday night, tickets should cost a bit more. You can even use part of the proceeds to subsidize tickets on other days so you’re not excluding more price-sensitive folks

Alcohol sales are another no-brainer. Every pandemic-strapped company has leaned into this and movie theaters should be no exception.

Partnerships with fast food chains like McDonalds for movie-themed Happy Meals. How is this not a thing?!

I think movie theaters will survive, mostly because they have survived thus far and the vaccine is right around the corner. As Aron says,

“If you want to know my mood, I’m very encouraged that multiple vaccines are rolling out globally,” he said. “To use a bad pun, it’s a real shot in the arm.”

What do you think? How long before you’ll feel comfortable going to a movie theatre?

Odds and ends of the week

An article sandwiched between two videos this week:

📦 How Amazon handles its logistics: A deep dive into how Amazon handles its ever-increasing logistics. Easily one of the best videos I’ve watched in a last few months – there’s just something about education and video that cannot be captured in text.

Shoutout to long time Snapshots reader David Perell for the recommendation!

⌚ The Untold Story Of Watchmaking's Most Iconic Advertising Campaign: Patek Philippe’s “You never really own a Patek Philippe” campaign is centered around a key principal – buying a watch that costs higher than the national median income is a decision driven by emotions. While watch blogs and subreddits form a key part of the hype cycle of complications and reference numbers, the core clientele making real purchasing decisions is driven by a need to status signal. I have a Rolex which means I have made it or I have an Omega Speedmaster so I care about technological advancements and the Space Age. There is an status signaling arbitrage element to this – my friends who work in banking and at hedge funds now think that Rolexes and Omegas are gaudy. Instead, they go for an IWC or Panerai but it’s still all the same principle of signaling. What makes the Patek Philippe campaign unique is that it’s timeless.

💣 The Second Hiroshima, Castle Bravo: We forget that we live under a global world order forged largely on gun point – the gun point of nuclear weapons. This video captures how these weapons of mass destruction were transformed from a blip in history to the dominant forces in international relations through the lens of the test named Castle Bravo in 1954.

That wraps up this week’s newsletter. You can check out the previous issues here.

If you want to discuss any of the ideas mentioned above or have any books/papers/links you think would be interesting to share on a future edition of Sunday Snapshots, please reach out to me by replying to this email or sending me a direct message on Twitter at @sidharthajha.

Until next Sunday,

Sid