Sunday Snapshots (12/06/20) – Obama's evolution, AI and Corporate Reporting, Spotify Wrapped

In which I wrap my head around Spotify Wrapped

Hey everyone,

Greetings from Washington, D.C.!

It’s a chilly day here in the national’s capital so there’s not much to do except for pouring myself a glass of cold brew, cracking open my notes, and writing this issue of Snapshots in which I want to explore:

Obama’s evolution as he assumes the Presidency

How to talk when the machines are listening

Wrapping my head around Spotify Wrapped

Old Japanese Shops, Industrial Beekeeping, and vaccines

Book of the week

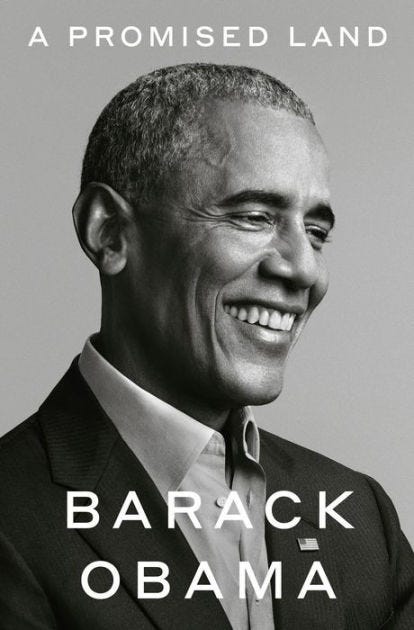

If there is a theme of the second third of President Obama’s biography, A Promised Land, it’s his evolution from a mature idealist into a grizzled realist with idealistic streaks.

Through the primary victories against his future Secretary of State Hillary Clinton and the relatively one-sided affair that was the 2008 Presidential Election against the late Senator John McCain, Obama’s relationship with the outside world changes. As it becomes increasingly clear that he is going be President, there now exists an abstraction of the man without his personal idiosyncrasies and flaws. For both his supporters and his detractors, he became an empty vessel for their hopes and dreams, their frustrations and disappointments, their idea of what was good or bad about the American enterprise. And this change did not just exist metaphorically but also literally. Even as one of the primary contenders for the Democratic nomination, he lost his anonymity; he could no longer go across the street to get groceries or grab a coffee. He had a press pool that would travel with him for almost every occasion – public or private. As his time became more valuable, he laments over the tight control over his schedule:

It’s as if I was merely an expensive prop to be taken out of the box under special conditions.

This (deserved) scrutiny into every part of his life and the lives of every one he was associated with became a problem for his campaign when a clip of one of the pastors from his church in Chicago, Reverend Wright, came out where he was criticizing American domestic and foreign policy in the harshest term. The crisis looked like it was going to derail the entire campaign. What followed was probably Obama’s best speech of his political career by then and until now. He painted a complex picture of a complex man in a complex country. He condemned Reverend Wright’s comments but acknowledged a deep, uncomfortable truth:

I can no more disown him than I can disown the black community. I can no more disown him than I can disown my white grandmother, a woman who helped raise me, a woman who sacrificed again and again for me, a woman who loves me as much as she loves anything in this world, but a woman who once confessed her fear of black men who passed her by on the street, and who on more than one occasion has uttered racial or ethnic stereotypes that made me cringe.

These people are a part of me. And they are part of America, this country that I love.

It’s a speech that turned the tides of the most formidable crisis of his campaign. It’s a speech that would make an excellent case study in a book like Ryan Holiday’s The Obstacle is The Way. But perhaps most importantly, it’s a speech that was considered at a time when it could have been reactionary, complex at a time when it could have gone for cheap sound bites, and persuasive when the stakes could not be higher. For me, it was Barack Obama at his very best – before he was even President. I highly recommend you read the entire transcript of the speech.

Throughout this section, Obama retains the usage of the perfect turn of phrase that I talked about last week. Awaiting election results, he thinks he is “like a patient awaiting the result of a biopsy.” Explaining how Michelle hated primary and presidential debates, he likens the experience for her like “getting a tooth drilled without novocaine.” Taking his first tour of the White House as President-Elect, he notes that every room in the West Wing was “built to accommodate the weight of history.”

Just like Lyndon Johnson’s first 100 days – long time readers of Snapshots know by now that I will grasp at the faintest opportunity to make an LBJ comparison – which were characterized by stabilizing the incident that led him into the White House, Obama’s first few weeks and months were characterized by putting the brakes on the 2008 financial crisis that he inherited from Dubya. If he was not cognizant of the time sensitiveness of how to use the veneer of a new presidency to pass through legislation that would help the cratering of millions of Americans, he was constantly reminded of it by his own staff. His Chief of Staff or “Lord High Executioner” – as the position was called by the first person to formally hold it – Rahm Emanuel noted:

The Presidency is like a new car. It starts depreciating the minute you drive it off the lot.

He faced some tough choices. On one hand, he had to deliver “Old Testament Justice” to banking executives who if not directly responsible, were at least ignorantly complicit in creating the conditions for the crisis. On the other hand, sustained liquidity in lending markets – the lubricant that keep global financial systems running – could be restored only if the government showed confidence in these banks. So going for the heads of the heads of these banks did not seem like a smart move. And it’s not like the complexities ended there. Between juggling the thankless task of avoiding a financial meltdown and constrained by the powerful (and ever tightening) influences of Democratic and Republican Congress, he had to make a series of decisions developed by Secretary of the Treasury Tim Geithner and his team that helped pull America out of the worst economic crisis since the Great Depression. At the end of it, he had spent about “two years of political capital in two months.” Congress would painfully remind him of this over the successive years. Furthermore, “the absence of catastrophe, the preservation of normalcy wouldn’t attract attention.” It was simply what a President did.

And that is perhaps the deep contraction of the Obama Presidency. In what would be a recurrent theme in his presidency, Barack Obama the passionate ran into Barack Obama the pragmatist – and Barack Obama the passionate lost without much of a fight.

I’ll be back with my take on the final third of A Promised Land next week.

Long read of the week

How to Talk When a Machine Is Listening by Sean Cao, Wei Jiang, Baozhong Yang and Alan L. Zhang

How would you change what you say if everything you said was being listened to, recorded, and analyzed? Not only that, but how would you change what you say and how you say it if that analysis directly led to how much money you would make at the end of the year?

For CEOs of publicly traded companies, that’s not a hypothetical question – it’s a hard reality.

From NBER’s own summary of the paper, here’s a take at how companies change the content of annual reports to make it easier it for machines to read them:

Companies expecting higher levels of machine readership prepare their disclosures in ways that are more readable by this audience. “Machine readability” is measured in terms of how easily the information can be processed and parsed, with a one standard deviation increase in expected machine downloads corresponding to a 0.24 standard deviation increase in machine readability. For example, a table in a disclosure document might receive a low readability score because its formatting makes it difficult for a machine to recognize it as a table. A table in a disclosure document would receive a high readability score if it made effective use of tagging so that a machine could easily identify and analyze the content.

They also change what words they use to please the machines:

After 2011, companies expecting high machine readership significantly reduced their use of words labelled as negatives in the finance-specific dictionary, relative to words that might be close synonyms in the Harvard dictionary but were not included in the finance publication. A one standard deviation increase in the share of machine downloads for a company is associated with a 0.1 percentage point drop in negative-sentiment words based on a finance-specific dictionary, as a percentage of total word count.

They change their tone of voice too:

Using machine learning software trained on a sample of conference call audio from 2010 to 2016, the researchers show that the vocal tones of managers at companies with higher expected machine readership are measurably more positive and excited.

Does it make you feel uneasy? It makes me uneasy that the same earning calls meant for humans are also being ruthlessly – no, dispassionately – scrutinized by algorithms. Perhaps we’re all – CEOs and non-CEOs – just creating 0 or 1s dancing to the tune of algorithms.

Business move of the week

Wrapping my head around Spotify Wrapped

Spotify might be the company that I admire the most. And it’s not because they have provided fodder for plenty of Snapshots issues – it’s because they are taking on two incumbents at once. Not only are they in a deal with the devil with music studios, but they face integrated competitors like Apple Music and YouTube Premium in the war for ear-share.

But despite their tug of war with the music studios and their treatment as second-class citizens on the iOS and Android platforms, they somehow always manage to cut through the noise. The acquisition of Gimlet Media, Anchor, and the Joe Rogan Experience made for big, splashy headlines over the last two years because of a systematic attack on the podcasting space. But this week, it was the old school, now seemingly ignored music streaming part of the business that got some much-needed love. Spotify Wrapped has blanketed my Instagram and Twitters feeds to a level of saturation that would make the Squarespace Podcasting Ads team proud. Its ubiquitousness was matched earlier this year only by the “I Voted” sticker selfies during election season.

But why does it matter at all? Of course, let’s dispense with the usual suspects: attention is limited and valuable, how music is social, and how every Apple Music user’s smugness is blunted by their inability to perform in this choreographed dance of status-seeking behavior. Let’s also dispense with the key strengths that it leverages that Spotify is uniquely qualified to deliver on: it’s got larger scale (286M subscribers including ad-supported users vs. Apple Music’s 80M paying users) which means more data, it’s built around playlists which leads to better discovering which allows you to showcase how you were into so-and-so before they went mainstream, and that it’s simply a level of software-enabled delight that Apple has not been able to port over from its hardware culture.

Embedded in Spotify Wrapped is an alternative glimpse of the company. As it stands today, it’s not a great business. It has to pay record labels up to 50% of its revenue. It’s got an internet company valuation without the oh-so-desirable zero marginal cost reality backing it up. It’s conventional wisdom in the space that its podcasting moves are an attempt to break these shackles. But as things stand today, customer behavior don’t choose podcast players based on content and the podcasting -> music or the music -> podcasting loop is unclear. Their attempts to build an ad network and other infrastructure are in process – it’s not clear at all that they will be successful.

So what if they had a life vest to be inflated in the case of an emergency?

Let’s take an alternative bet. A bet that says Spotify is not a music streaming business, but a music experience one. And let’s use Spotify Wrapped as an example for what this could look like.

What are the things that one could do with Spotify Wrapped to increase revenues from existing customers and attract new ones? A few ideas come to mind:

The Merch Play: Sell personalized merchandise like apparel, posters, or plaques with some element of your Spotify Wrapped. You only get the option to purchase if you are a Spotify Premium member. Some percent of this revenue will go to artists which could be valuable for up-and-coming ones. I can see this get a lot more cultural cache as specific pieces (think a sweatshirt saying you are one of Beyonce’s top 0.01% listeners) might end up on StockX.

The Community Play: Create communities of an artist’s top 0.1% listeners. This is the kind of proof-of-work that’s difficult to fake and creates a sense of belonging in a community. You can have listening parties, album drops, etc. through these communities.

The Exclusives Play: Host exclusive concerts or customized thank you messages from artists. This especially allows the tail end of artists to create a greater sense of connection. It also doubles down on the user’s image of themselves as a tastemaker and if appealing to your user’s vanity is rarely a losing proposition in business.

This stuff is more broadly important because companies go through a natural evolution cycle. And there is not one pre-defined evolutionary path. There are multiple versions of the future that could be realized. One version of Spotify’s future is that it becomes a high-margin podcasting behemoth and doesn’t need music streaming. That is what Wall Street seems to be banking on. But another version is that those moves don’t pan out and having exhausted the best quality growth that comes earlier in a company’s life, Spotify might need to explore other options like leveraging Spotify Wrapped into a revenue generating opportunity. This would be lower margin growth, but it would be growth nonetheless.

Of course, there are limitations to this analysis. For one, I am greatly underestimating the ambition of Daniel Elk and co. They seem to be going for occupying as much of ear share as possible. Other possibilities for the company also exist. If they can leverage their customer base into decreasing studio royalty fees, that would be impressive. It’s not clear if they can. Maybe the options I laid out above are so different from the DNA of the company. After all, I asked a playlist-centric company to become community-centric, merchandise-centric, and artist-centric all at once. A unified experience between all three would be very tough to achieve.

My parting thoughts are that while the company seems to putting all its eggs in the podcasting basket, it would be valuable for executives and analysts to look for alternative pathways to a sustainable business that captures some of the immense social capital that the company generates for its artists and fans.

Odds and ends of the week

An article, a video, and a tweet this week:

🇯🇵 This Japanese Shop Is 1,020 Years Old. It Knows a Bit About Surviving Crises: A beautiful portrait of what long-term thinking allows you to do in the midst of a crisis. My favorite line – “Their No. 1 priority is carrying on.”

🐝 How Expert Beekeepers Harvest Honey From 2 Million Bees: In some future life, I envision myself leisurely donning on a Beekeeping Suit after my first cup of coffee for the day to tend to my bees and spend my days as a semi-professional apiarist. This is not that. This is industrial beekeeping. Fascinating.

💉 Phineas and Ferb: Not everything is serious here in Snapshots-land. After harping on Presidential legacies, corporate disclosures, and music streaming giants, allow me to share a tweet that me <insert spit take gif that’s not actually Jennifer Lawrence>:

That wraps up this week’s newsletter. You can check out the previous issues here.

If you want to discuss any of the ideas mentioned above or have any books/papers/links you think would be interesting to share on a future edition of Sunday Snapshots, please reach out to me by replying to this email or sending me a direct message on Twitter at @sidharthajha.

Until next Sunday,

Sid