Sunday Snapshots (7th July, 2019)

The Art of Learning, risk, my summer project, Costco, and Our Planet

Hey everyone,

This was a slow week with the 4th of July weekend. I worked from home for a few days which meant it was easier to switch into reading mode. Here’s what I want to talk about this week:

How to walk the tightrope between process and outcomes

Why is risk so poorly understood

My Summer of Learning project

Costco’s resilience in the Amazon era of retail

And more!

Book of the week

I can’t believe I had not come across Josh Waitzkin’s The Art of Learning. Waitzkin puts into words a lot of conflicts I’ve had over the last 4 years. There are two ideas that caught my eye.

First, there is often a conflict between process and outcomes – do you focus on your long term goals and the learning, or do you optimize for the short term win? It’s not always possible to reconcile them. Waitzkin suggests that we “internalize a process-first approach by making everyday feedback respond to effort over results.” However, it’s important to get this feedback everyday so you’re focused on your long term growth. Then when a short-term checkpoint comes up, you’re free to optimize for that. This is a system that allows you to walk the tightrope between process and outcomes.

Second, psychological death spirals start with a small mistake. As Waitzkin explains:

The first mistake rarely proves disastrous, but the downward spiral of the second, third, and fourth error creates a devastating chain reaction.

The way to avoid these are to step away from the situation. This can mean taking a deep breath, splashing cold water on your face, or leaving the physical situation and going for a quick 2 minute walk.

The Art of Learning is a great book. I highly recommend you read it.

Long read of the week

On Time and Risk by Ole Peters

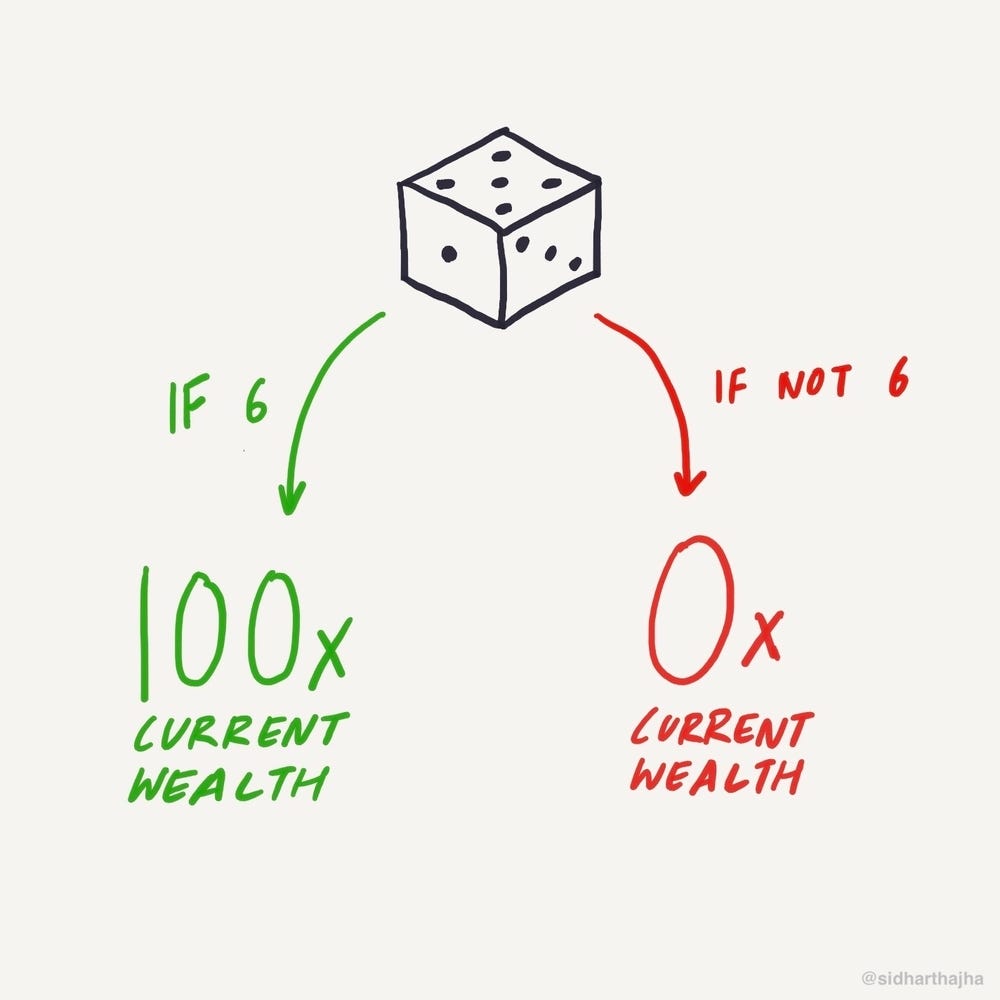

This is a short paper on risk, probability, outcomes, and how to stay in the game long enough to win. It starts with a simple experiment:

You roll a dice, and if you throw a six, I will give you one hundred times your total wealth. Anything else, and you have to give me all that you own, including your retirement savings and your favorite pair of socks.

Should you take this wager? If you do an expected outcome calculation, the answer is yes. But you shouldn’t take up the author on this, because losing means you lose your ability to play the game – you don’t have anything to play with!

I highly encourage you to read this because Peters lays out the divide between mathematics and human gut feel and how this leads to our poor understanding of risk.

Personal update of the week

I started my Summer of Learning project this week. I’m writing every day for 60 days. Here’s the plan.

This week, I wrote about:

If you have enjoyed this newsletter, I’m sure you’ll enjoy Summer of Learning. Please send me books/topics/people you’d like me to write about by replying to this email or DMing me on Twitter at @sidharthajha.

Gesture of the week

Bringing a random smile is one of the greatest gestures you can offer. @dog_rates on Twitter does this consistently for me. There are also a few subreddits that elicit a similar feeling: r/MasterReturns, r/DogWithJobs, and r/PetTheDamnDog.

Business move of the week

How Costco quietly became a $7-billion fast-fashion powerhouse

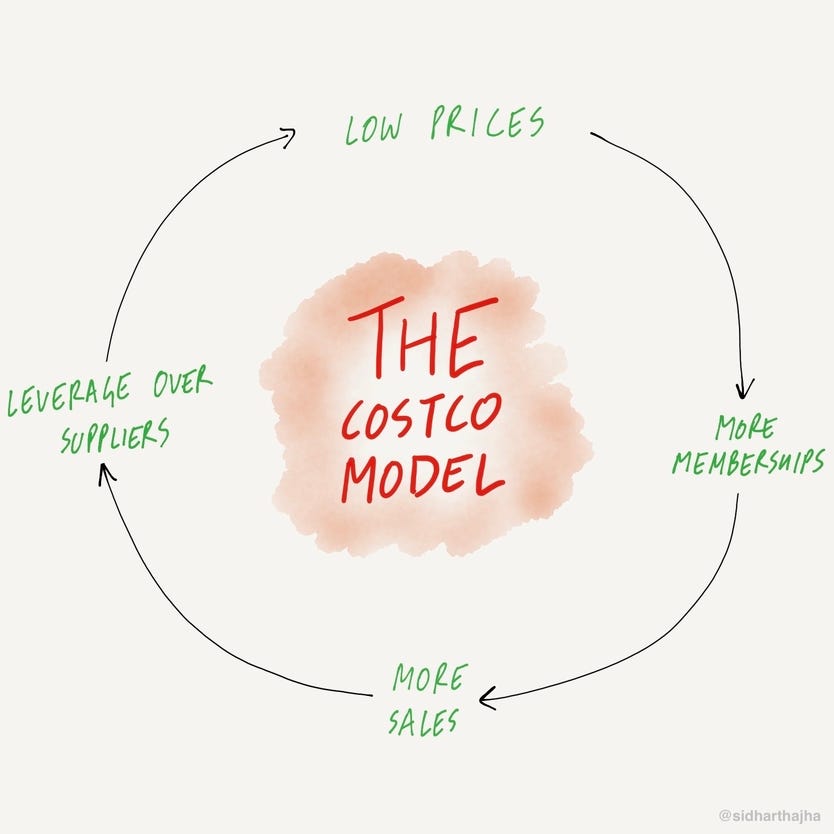

Over the last two weeks, I’ve written quite a bit about leveraging your unique strengths. This is a story about how Costco became a fashion powerhouse, but I want to take the opportunity to talk generally about how Costco has remained resilient by leveraging its unique strengths while other retailers like Walmart have struggled under Amazon’s rise.

In an era of convenience, Costco is thriving with its physical stores. Its sales and profit are climbing. They continue to open new stores. How is this possible?

Retailers make most of their money by marking up their wholesale purchases. But Costco marks up its products by only 15% at most. By the time they’ve paid for labor costs and logistics, they break even. The genius of this model is that because there is virtually zero marginal cost to issue an additional membership, their annual $60 membership is pure profit.

Since they don’t make money on product sales, they are able to keep prices low, which attracts memberships, which attracts sales, which allows them to get volume discounts from suppliers, which allows them to keep prices low! This is an incredible positive feedback loop that makes Costco resilient in the Amazon era.

Random corner of the week

This week, I watched Our Planet, a nature documentary series narrated by David Attenborough. The shots that they have managed to get are unbelievable and many look CGI-ed. It’s a great show to put in the background while you’re working. Here are a few stills:

Meal of the week

Last week, I went to Ēma on 74 W Illinois St in River North. I’ve been there a couple of times and the consistency of their food and service amazes me. It’s sacrilegious to not order the hummus or the spicy hummus spread. I typically get the Chicken Kebabs but went with the sandwich this time. My friend had Coconut Curry Mussels which were also really good.

That wraps up this week’s Sunday Snapshots. If you want to discuss any of the ideas mentioned above or have any books/papers/links you think would be interesting to share on a future edition of Sunday Snapshots, please reach out to me by replying to this email or sending me a direct message on Twitter at @sidharthajha.

Until next Sunday,

Sid