Foxtrot: The 21st Century Corner Store

An essay on the contemporary convenience store chain

Hey everyone,

Greetings from Chicago!

I’m visiting Chicago this week. On Friday afternoon this week, I found myself in the West Loop neighborhood between plans and decided to check out a store that I have visited intermittently since 2018.

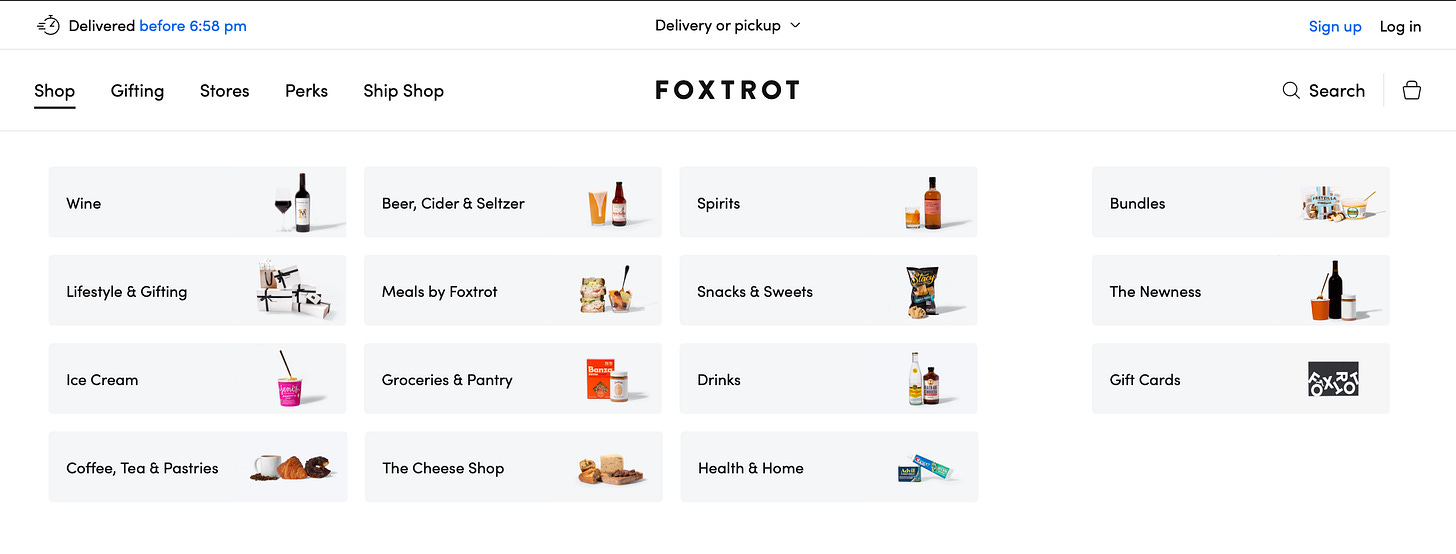

Foxtrot brands itself as a contemporary convenience store chain. From my experience, it’s a big of a catch-all one-stop shop for the millennial lifestyle. In the fridge, you can find Jeni’s ice cream tubs alongside Recess sparkling waters. In the store front, you can find Marvis toothpaste alongside Banza Pasta. At the back of the store, you can find local wine alongside White Claws. If you want to know which brands your local 24-35 year old demographic is consuming and you happen to be in Chicago, D.C., or Dallas1, you should pay a visit to your nearest Foxtrot.

It is apparently pretty good at doing this, as they recently raised a $42M Series B2. The chief investors in the round included David Chang of Momofuku and subsequent Netflix fame, folks from sweetgreen, and the CEO of Whole Foods.

So what are the key drivers of this business? Fundamentally, the company differentiates itself through perceived or actual superior curation for the millennial demographic. To grow, it rides on the demand wave of delivery-based-convenience stores by utilizing the logistics rails laid down by DoorDash. And to retain its best customers, it offers them an incentive to spend more.

Ultimately, the company is creating a playbook on how to do retail right in the 21st century.

Curation as a service

You don’t go to Foxtrot to buy Tide Pods. You go to Foxtrot to buy Dropps.

This points to a broader “problem” that Foxtrot solves for. There has been an explosion in DTC companies over the last half decade. These have been fueled by a variety of factors including a low interest rate environment, the proliferation of business-in-a-box platforms like Shopify, and overall solid consumer sentiments.

How do you distinguish between them? Humans look for approval from tastemakers like Foxtrot. By having your product displayed at a hip location like Foxtrot, you can signal to customers and investors that you are a brand which they should back with your money.

Long gone are the days when the retail strip mall in the suburbs would be the center of taste making. Today, that happens either on the internet threw a slurry of hyper-targeted advertising or through an upscale retail location like Foxtrot.

It’s kind of a win-win for both the companies being stocked on the shelves and for Foxtrot. The DTC companies get to test out how their products perform in a physical retail setting that informs broader relationship decisions with bigger retail partners like Target and Walmart. And Foxtrot gets to stock its shelves with premium products.

And of course in classic Michael Scott style, it’s actually a win-win-win because the customer wins as well, by having the latest and greatest products available to them within a 60 minute window — which brings us to delivery.

Delivery enablement

Foxtrot promises 60 minute delivery in neighborhoods near its stores. While that fact by itself is not that interesting, there is a broader trend that is interesting here. Many stores and logistics-based platforms3 are plugging into the DoorDash network to create delivery experiences that were impossible for companies below a certain threshold — a threshold that was pretty high.

In some sense, DoorDash is acting like a platform of platforms. By enabling marketplaces like Farmstead, it allows them to go much beyond the prevalent view of them as a restaurant-to-customer delivery app. From DoorDash: Re-Inventing Last-Mile Logistics:

The DoorDash of today isn’t the end state DoorDash. DoorDash is aggregating consumers, Dashers and merchants on its platform and adding great value to each party. This paves the path for the company to one day dominate last-mile logistics and upsell their customers with higher-margin products and services. Each new vertical DoorDash makes available to users will help achieve achieve greater density and offer additional benefits to users. The end state DoorDash will have great barriers to scale, as well as the most consumers, the widest selection of merchants and Dashers. With the advantages of scale, DoorDash will offer its merchants and users the lowest costs and the highest earnings potential for Dashers.

The merchants in that line is not just restaurants, but businesses like Foxtrot. This allows these businesses to grow their delivery presence in risk-free way since they do not have to hire their own drivers and cars.

As a side note, these delivery rails provided by DoorDash enables all kinds of new opportunities to play with delivery experiences for small companies — you can plug-and-play into one of the largest delivery fleets in the world like you’re firing up a virtual server using AWS. That’s incredibly powerful and deeply under appreciated.

Loyalty program

In the boardrooms of growing companies which contemplate some sort of subscription or loyalty program, the inevitable question an executive will ask is simple: how do we avoid simply giving our best customers a discount or a freebie? In other words, how can companies make the loyalty programs work in a way that benefits the company?

Foxtrot tackles this in a way that reminds of the Amex black card4 — admission is based not by paying something upfront, but by passing a spending threshold. This means that you are not attracting deal pickers who will suck off margins, but loyal customers who would shop at your stores any ways. The free coffee is nice and pretty smart, as it ensures that people will come into your stores much more frequently. With $100 not being a crazy high bar for monthly spend for a convenience store, I can definitely see customers shift spend away from other retailers towards Foxtrot.

It’s a simple and smart program that seems to be working for them. During my 10-15 minute visit to the store, I saw 2 customers log in with their app to get a discount on their purchases.

What’s next?

In the near future, Foxtrot is looking to expand into new geographies. Given its current portfolio of only 3 cities, that certainly seems like a good priority. I’m excited to see how the lessons and tactics they have learned in Chicago, D.C., and Dallas fare in new markets. In capturing new markets, they will continue to re-invent the 21st century retail playbook that they have been writing over the last few years.

Until next Sunday,

Sid