Reagan's Notecards, Buffett's Letter, and Foxtrot as a tastemaker for tastemakers

In which I quote a lot of people

Hey everyone,

Greetings from Washington, D.C.!

Continuing the theme from last time, it’s been a busy week for me. I am grateful to have the opportunity to contribute to the S-1 club’s report on Coupang—the “South Korean Amazon”— hosted by the gracious Mario Gabriele. I have some amazing co-authors and the report drops next week. I am super excited for it and I hope you will read it!

In other news, I heard somewhere recently that you should always have something you are looking forward to—a vacation, a book, or a reunion with loved ones. I am currently looking forward to the daylights savings time switch in a couple of weeks so that everyone on the East coast can get an extra hour of sunlight. In these now-precedented times, I’ll take the little things.

In this issue of Snapshots, I want to talk about:

The system of notecards Ronald Ronald used to become the “Great Communicator”

My notes on Warren Buffett’s 2020 Annual Letter

Why Foxtrot is the tastemaker for tastemakers

Bearbricks, Chinese censorship, and the Citroën DS

Book of the week

Whatever your political alignment, you have to agree that Ronald Reagan was one of the best communicators to occupy the Oval Office. Out of the two necessary arts of leadership—plumbing and poetry,— he was much better at the latter. The “Great Communicator” was aptly named.

But how did he achieve this? While there was a certain natural Californian charm to his speech and the acting skills he had honed in his earlier years definitely helped, there was a lot of deliberate practice behind the effortless delivery of “Mr. Gorbachev, tear down this wall!” and other such historical speeches.

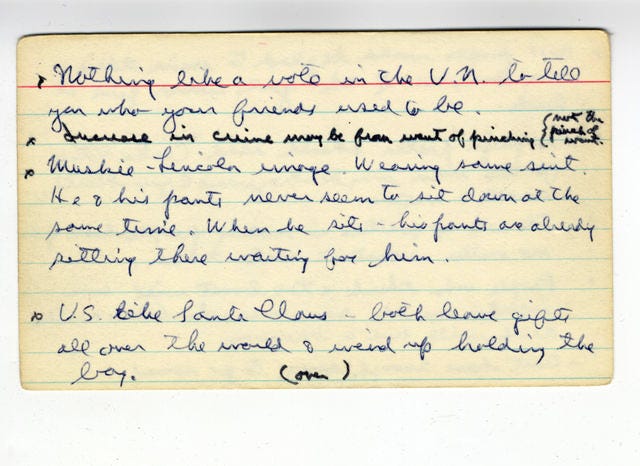

Critical to this practice was a system of notecards that he had maintained since his years on the lecture circuit at General Electric—that’s decades of material. All these are collated in The Notes: Ronald Reagan’s Private Collection of Stories and Wisdom, edited by Douglas Brinkley.

It was this system that led to anecdotes like this in the book:

As speechwriter Aram Bakshian noted, “I used to spend a lot of time writing funny lines in the President’s speeches. Then I’d see them taken out by the President in favor of better lines that he would add.”

To capture the range of quotes that he could pull from at will using this collection of 4x6 index cards, here are some examples:

On military preparedness:

“There can be only one possible defense policy for the U.S. It can be expressed in one word—the word is 1st. I do not mean 1st when—I don’t mean 1st if—I mean 1st, period.” — John F. Kennedy

On Liberty:

Liberty is always dangerous but it’s the safest thing to have.

Dissing Congressmen:

Those Congressmen who worried about being bugged by the FBI—you’d think they’d be glad someone was listening to them.

Main Street wisdom:

Beware of those who fall at your feet. They may be reaching for the corner of the rug.

And of course, on taxes:

Taxpayers—that’s someone who doesn’t have to pass a civil service exam to work for the government.

The entire book is filled with interesting quotes. It’s inspired me to start my own set of index cards filled with anecdotes, examples of good writing, and catchy phrases.

So, in order to kickstart the process, I’d love to hear from you. What’s your favorite quote or anecdote that you’ve come across recently? If I get enough responses, I’ll create a thread on my Twitter account and give you a shoutout!

Long read of the week

Buffett’s 2020 Annual Letter (Annotated, Original)

So yeah, every year a bunch of finance heads descend into the idyllic city of Omaha, Nebraska and discuss words like “compounding”, “time in market”, and “dividends.” Last year, they had to descend digitally onto a livestream. I suspect they will have to do the same this year.

And who am I to mess with tradition? I too, put my thinkboi hat on yesterday and got to reading Berkshire Hathaway’s 2020 annual letter by Warren Buffett. A few interesting quotes from this issue:

No prizes for degree of difficulty:

If that [investing and holding for a long time] strategy requires little or no effort on our part, so much the better. In contrast to the scoring system utilized in diving competitions, you are awarded no points in business endeavors for “degree of difficulty.” Furthermore, as Ronald Reagan cautioned: “It’s said that hard work never killed anyone, but I say why take the chance?”

Berkshire’s ownership of property in the US:

Recently, I learned a fact about our company that I had never suspected: Berkshire owns American-based property, plant and equipment – the sort of assets that make up the “business infrastructure” of our country – with a GAAP valuation exceeding the amount owned by any other U.S. company. Berkshire’s depreciated cost of these domestic “fixed assets” is $154 billion. Next in line on this list is AT&T, with property, plant and equipment of $127 billion.

On the importance of railroads in commerce ($BNSF is one of Berkshire’s largest holdings):

Your railroad carries about 15% of all non-local ton-miles (a ton of freight movedone mile) of goods that move in the United States, whether by rail, truck, pipeline, barge or aircraft. By a significant margin, BNSF’s loads top those of any other carrier. The history of American railroads is fascinating. After 150 years or so of frenzied construction, skullduggery, overbuilding, bankruptcies, reorganizations and mergers, the railroad industry finally emerged a few decades ago as mature and rationalized.

Question: what is the best book to learn about the development of the railway systems in the U.S.? Send me your recommendations by replying to this email or sending me a DM on Twitter.

The rare Buffett investment based on vision instead of operating excellence:

Historically, the coal-based generation of electricity that long prevailed was located close to huge centers of population. The best sites for the new world of wind and solar generation, however, are often in remote areas. When BHE assessed the situation in 2006, it was no secret that a huge investment in western transmission lines had to be made. Very few companies or governmental entities, however, were in a financial position to raise their hand after they tallied the project’s cost. BHE’s decision to proceed, it should be noted, was based upon its trust in America’s political, economic andjudicial systems. Billions of dollars needed to be invested before meaningful revenue would flow. Transmission lineshad to cross the borders of states and other jurisdictions, each with its own rules and constituencies. BHE would also need to deal with hundreds of landowners and execute complicated contracts with both the suppliers that generated renewable power and the far-away utilities that would distribute the electricity to their customers. Competing interests and defenders of the old order, along with unrealistic visionaries desiring an instantly-new world, had to be brought onboard.

All jokes aside, the letter is a good read and I hope we appreciate Buffett and Munger while we can. I’m sure they can do the math,1 and we should too.

Business move of the week

Foxtrot: The Tastemaker for Tastemakers

Foxtrot Market, the corner store and café redefining convenience for the modern consumer, announced this week that it has received a $42 million Series B growth investment. The chief investors included David Chang of Momofuku, folks from sweetgreen, and the CEO of Whole Foods.

It reminded me of a story I’ve always wanted to tell on this newsletter. Like every college student, I was often cash strapped when I was at Northwestern. But during my summers in Chicago while I had internships, there was new found capital available for little luxuries. One of those luxuries was a trip to the Foxtrot in West Loop for a post-lunch pick-me-up coffee.

Why did I enjoy going there instead of Starbucks or La Colombe? The main reason was that there who always be new products in their retail section that you could browse while your coffee was being prepared. There would be new CPG brands, new snacks, and just other cool stuff. It didn’t seem like much but my tastes were being honed in those afternoon walks to the modern corner store.

I was working at a CPG company that focused on men’s grooming products that summer. So I would try to see which of our competitors were featured and come back to our office to report about their shelf placement—a loose proxy for marketing spend. I even managed to convince that local Foxtrot to stock our product! And I would go back every day to check how many units they sold. I would personally deliver re-stocks.

I took a certain pride—grounded in real world status signaling—that I knew about all these brands that were featured at Foxtrot. In the microcosm of Chicago CPG brands, I was a tastemaker. I was certainly a tastemaker when I brought samples of products and gave them to my friends to try out.

Looking back, Foxtrot was a tastemaker for my journey as a tastemaker. Why is this important for the ecosystem and not just some random story that I am telling about my own experiences?

There has been an explosion in DTC companies over the last half decade. These have been fueled by a variety of factors including a low interest rate environment, the proliferation of business-in-a-box platforms like Shopify, and overall solid consumer sentiments.

How do you distinguish between them? Humans look for approval from tastemakers and tastemakers in turn are exposed to new products in stores like Foxtrot. So, by having your product displayed at a hip location like Foxtrot, you can signal to customers and investors that you are a brand to back with your money.

Long gone are the days when the retail strip mall in the suburbs would be the center of taste making. Modern corner shops like Foxtrot in middle of cities have replaced them. D.C. has it’s own version of Foxtrot—Union Kitchen, which doubles as a CPG brand accelerator. I have no doubt that Foxtrot will develop similar products.

Odds and lots of the week

Bearbrick: The New LEGO for Adults: Ah, the rare Jerry Lu drop. I’ve shared Jerry’s work here before because he’s easily one of my favorite up-and-coming writers. For me, he hits the dead center of the kind of writing I like to read—something I have noticed but don’t know much about, is written by someone much more culturally plugged into the product than me, and is very well written. It’s rare that one of his pieces doesn’t skip the queue and take first spot on my reading list.

I helped built China’s Censorship Machine: What a harrowing account by a former ByteDance—the company behind TikTok—employee about the censorship machine built by the company. The whole piece was summarized for me by this quote (see some of my other highlights here):

When I was at ByteDance, we received multiple requests from the bases to develop an algorithm that could automatically detect when a Douyin user spoke Uyghur, and then cut off the livestream session. The moderators had asked for this because they didn't understand the language. Streamers speaking ethnic languages and dialects that Mandarin-speakers don't understand would receive a warning to switch to Mandarin. If they didn't comply, moderators would respond by manually cutting off the livestreams, regardless of the actual content. But when it comes to Uyghur, with an algorithm that did this automatically, the moderators wouldn't have to be responsible for missing content that authorities could deem to have instigated "separatism" or "terrorism."

The Timeless Beauty of the Citroën DS: To continue the streak of hypnotic videos that people have been enjoying, here’s a video about the mystical Citroën DS. Get lost for 5 minutes.

See Robert Caro’s Working, Introduction, pg. xxiv

That wraps up this week’s newsletter. You can check out the previous issues here.

If you want to discuss any of the ideas mentioned above or have any books/papers/links you think would be interesting to share on a future edition of Sunday Snapshots, please reach out to me by replying to this email or sending me a direct message on Twitter at @sidharthajha.

Until next Sunday,

Sid