Sunday Snapshots (1st September, 2019)

Scaling issues, predicting hits, the delivery wars, and Peloton

Hey everyone,

I hope all of my readers in the US and Canada are having a relaxing Labor Day weekend, and, as always, a happy normal weekend to everyone else!

This week I want to talk about:

JFK, scaling issues, and privilege

Predicting hit songs using machine learning

How restaurants think about delivery apps

Peloton’s S-1

And more!

Book of the week

We continue to talk about An Unfinished Life: John F. Kennedy by Robert Dallek. This week, I read about his early adolescence and college years at Harvard. Here are three themes that stood out to me.

1) Scaling issues: JFK’s father had a meteoric rise from a small time merchant to one of the most powerful people in the United States. As is often the case in scaling fast, there were some issues. The Kennedys, especially Rose Kennedy (JFK’s mother), faced a tension between their religious education and the comfortable existence opened to them.

2) A life of privilege: JFK lived a luxurious life. He took frequent trips to Europe during his college years, staying at opulent palaces and houses. When it came to writing his Senior thesis about appeasement in 1930s England, his father put him in touch with embassies across Europe where he spent significant time touring. Talk about a leg up in life!

3) Generalists: At Harvard, JFK was a generalist. Even though he didn’t do well in his classes, he developed an interest in contemporary affairs:

One classmate remembered that JFK was able to answer between 50 and 60 percent of the questions on the popular radio quiz show Information, Please, while he himself could only get about 10 percent of them right. He became a regular subscriber to the New York Times, reading it every morning. He also began a lifelong fascination with the writings of Winston Churchill.

I’ve been really enjoying this biography. More on it in the coming weeks.

Long read of the week

Song Hit Prediction: Predicting Billboard Hits Using Spotify Data

Researchers at University of San Francisco claim that they can predict whether a song is going to be a Billboard hit with 88% accuracy – that’s really high! The performance is more impressive when you consider that the dataset they used contained 1.8 million tracks, out of which 12,000 tracks or 0.67% of the total track were Billboard hits. That’s a serious “class” imbalance in the dataset. The researchers used four different algorithms and 27 features or characteristic of the songs to predict which ones were going to be hits.

To evaluate the four algorithms, they used three measures – accuracy, precision, and recall. Here’s what they mean:

1) Accuracy means what % of the data was correctly classified as a hit or not a hit. This is a typical measure to look at when evaluating performance of an algorithm.

2) Precision means what % of the data was actually a hit out of all the data predicted as a hit. Precision is important when you don’t want false positives. For example, you don’t want a music label to invest in a song which is unlikely to become a hit.

3) Recall means what % of the data was predicted a hit out of all the data that was actually a hit. This is helpful when there is a false negative. For example, the music label doesn’t want to miss out on a hit that was predicted as a non-hit.

Typically, there is a tradeoff between precision and recall. The direction you skew your results depends on your use case. For example, you might want to favor precision in email spam filters since if non-spam gets classified as spam, you might lose important information. On the other hand, if you’re a venture capitalist, you want to favor recall as you don’t want to miss out on the next Uber!

This is a great paper if you’re just starting to learn about machine learning since it discusses most of the common classification algorithms, evaluation techniques, and nuances associated with the process of transforming a business question into a business answer through data analytics.

Business move of the week

Domino’s Pizza Goes It Alone on Delivery

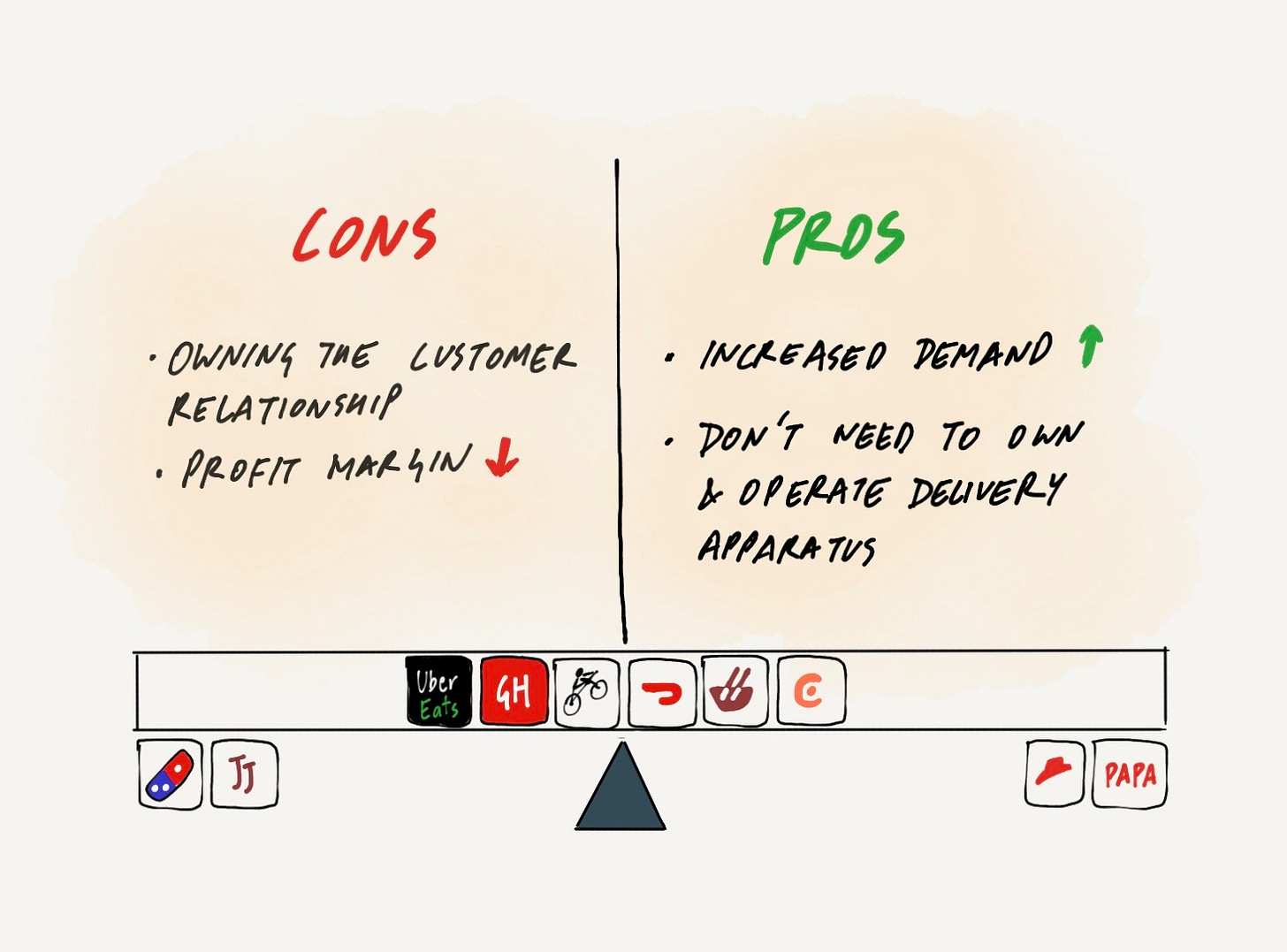

Whenever you outsource some part of the customer experience, there is a risk associated with how that affects your brand and your bottom line. Usually companies will outsource something that is not their core competency.

Food delivery companies have a simple business proposition – we will take a revenue cut from the orders delivered through our app but will expand the demand of your business. Restaurants get to decide whether the tradeoff is for them.

Dominos has decided it’s not for them:

Domino’s Pizza Inc. is one of the largest chains to stay off the new third-party delivery apps altogether. The company relies on its own employees to make deliveries from its 6,000 U.S. stores and most of its 11,000 international ones, and it runs its own online-ordering app. Chief Executive Ritch Allison said the profit hit and reputational risk of working with delivery companies isn’t worth the extra sales.

Owning the customer relationship is also important to them:

Executives were also reluctant to surrender control of the customer data that they use to target consumers with marketing based on their past orders.

It’s a delicate balance, one that companies will scramble to figure out in the next few years.

IPO of the week

Fitness startup Peloton released their S-1 filing last week. Despite being the victim of probably the funniest thread ever, it’s a pretty solid business!

A company can be thought of as a bucket of liquid with a hole at the bottom. You can have liquids (types of customer) flowing into the bucket (growth) and liquids going out of the bucket at the bottom (churn).

In this model, you have four levers to pull:

Change the type of liquids flowing in or out (attract better customers)

Increase the flow of liquids into the bucket (attract new customers)

Decrease the flow of liquids out of the bucket (reduce churn)

Change the bucket (play in a new market)

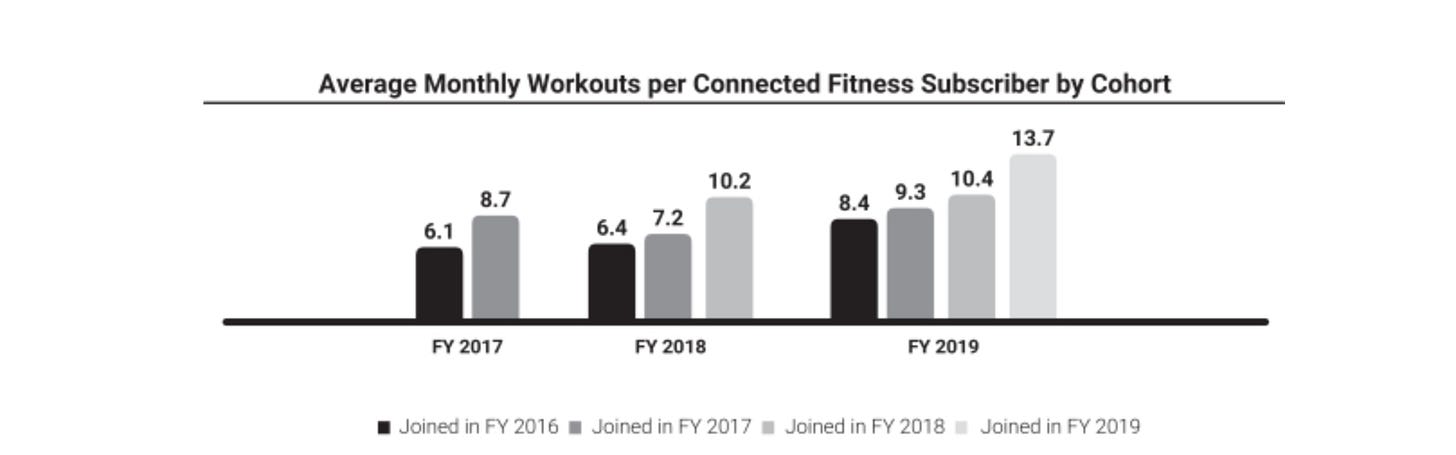

If I apply this model to Peloton, the thing that stands out to me the most is the decreasing CAC and corresponding increasing engagement (screenshot from the S-1).

Startups typically have low Customer Acquisition Costs (CAC) when they start out. This is confusing because you’d guess that it takes a lot of money and effort to get the initial momentum of users going. While that may be true, your first users are going to be users who really like your product and probably took little convincing (read: marketing dollars) to try it out. As your customer base grows, you’ll attract customers that will require more marketing dollars to use your product. This typically means that later customer cohorts have lower engagement rates.

For Peloton, it’s the exact opposite. Later cohorts are more engaged – do more workouts per month on average – than earlier cohorts. They’ve been able to grow with better customers than before flowing into the Peloton bucket. This combined with low churn rates makes them a force to reckon with in the fitness space.

Meal of the week

This is a bit of a blast from the past from my favorite ramen shop – Ivan Ramen in NYC. Ivan Orkin’s restaurant is the most consistent ramen experience. I like the Pickled Daikon and the Chicken Paitan Ramen.

That wraps up this week’s Sunday Snapshots. If you want to discuss any of the ideas mentioned above or have any books/papers/links you think would be interesting to share on a future edition of Sunday Snapshots, please reach out to me by replying to this email or sending me a direct message on Twitter at @sidharthajha.

Until next Sunday,

Sid